Get the free st119 1 form

Show details

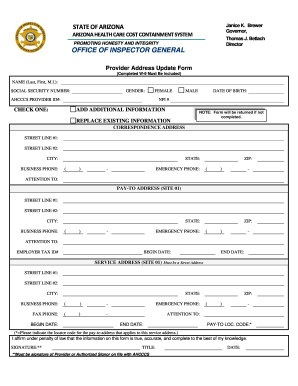

New State York Department taxation Finance and New York State and Local Sales and Use Tax ST-119.1 Exempt Organization Purchase Certificate (7/02) D Single purchase certificate D Blanket certificate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st119 1 form

Edit your st 119 1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 119 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 119 1 fillable form online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit st 119 1 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st 119 form

How to fill out st 119 1 form?

01

Ensure that you have the correct version of the st 119 1 form. It is important to use the most up-to-date form to avoid any errors or complications.

02

Begin by providing your personal information accurately. This typically includes your full name, address, and contact details. Make sure to double-check all the information for accuracy.

03

Next, fill in the required details regarding your employment status. This may include providing information about your employer, job position, and duration of employment.

04

Proceed to fill out the necessary information related to your income. This may involve disclosing your salary or wages, as well as any additional sources of income you may have. Ensure that you provide accurate and up-to-date financial information.

05

Be sure to complete any additional sections or questions on the form that are relevant to your individual situation. This may vary depending on the purpose of the form or any specific requirements set by the organization requesting the form.

06

Finally, review the completed form thoroughly to ensure all the information provided is accurate and legible. Double-check for any missing or incomplete sections that need to be filled out.

Who needs st 119 1 form?

01

Individuals who are seeking to claim tax benefits or exemptions related to their employment or income may need to fill out the st 119 1 form. This is typically required by tax authorities or organizations handling tax-related matters.

02

Employees who are eligible for specific tax deductions, allowances, or credits may be required to provide this form to their employer or government agencies to substantiate their claims.

03

Employers may also request employees to fill out the st 119 1 form for internal record-keeping purposes or to comply with legal obligations related to tax reporting.

Overall, the st 119 1 form is necessary for individuals who need to provide accurate information regarding their employment status and income for tax-related purposes.

Fill

st119

: Try Risk Free

People Also Ask about st 119 1 blank form

What qualifies you to be tax exempt individual?

The basic exemption limit for individuals below the age of 60 years is Rs. 2.50 lakhs. For senior citizens the exemption limit is Rs. 3 lakhs and for very senior citizen who are above 80 years, it is Rs.

What is a New York sales and use tax certificate of exemption?

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

How do I fill out a PA exemption certificate?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

How do I get tax exempt status in NY?

You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

How do I become tax exempt in NY?

You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and. You do not expect to have a New York income tax liability for this year.

What qualifies you as exempt on taxes?

You can only file as exempt for the tax year if both of the following are true: You owed no federal income taxes the previous year; and. You expect to owe no federal income taxes for the current year.

How do I get a tax exempt certificate in Canada?

You must give TBG a Purchase Exemption Certificate (PEC) at the Time of Sale. It must have Name, address, type of business, reason for claiming exemption, List of all items being purchased, date the PEC is issued, signature of Purchaser or approved official of the business, Vendor Permit Number if applicable.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nys st 119 1 form without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your st 119 fillable form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I fill out form st 119 1 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign st 119 form pdf and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit how to fill out nys required fields are completed accurately on an Android device?

You can edit, sign, and distribute form st 119 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is nys st 119 1?

NYS ST-119.1 is a New York State sales tax exemption certificate used by certain buyers to claim exemption from sales tax on purchases.

Who is required to file nys st 119 1?

Businesses or individuals making purchases that qualify for sales tax exemption in New York State are required to file NYS ST-119.1.

How to fill out nys st 119 1?

To fill out NYS ST-119.1, you must provide your name, address, the type of exemption, and details of the purchase. Ensure all required fields are completed accurately.

What is the purpose of nys st 119 1?

The purpose of NYS ST-119.1 is to document a buyer's claim for a sales tax exemption when making eligible purchases in New York State.

What information must be reported on nys st 119 1?

The information that must be reported on NYS ST-119.1 includes the purchaser's details, the exemption reason, date of purchase, and a brief description of the purchased items.

Fill out your st119 1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

st119 Form is not the form you're looking for?Search for another form here.

Keywords relevant to st 119 tax exempt form

Related to st 119 1 form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.